Investment Opportunities

Product Details

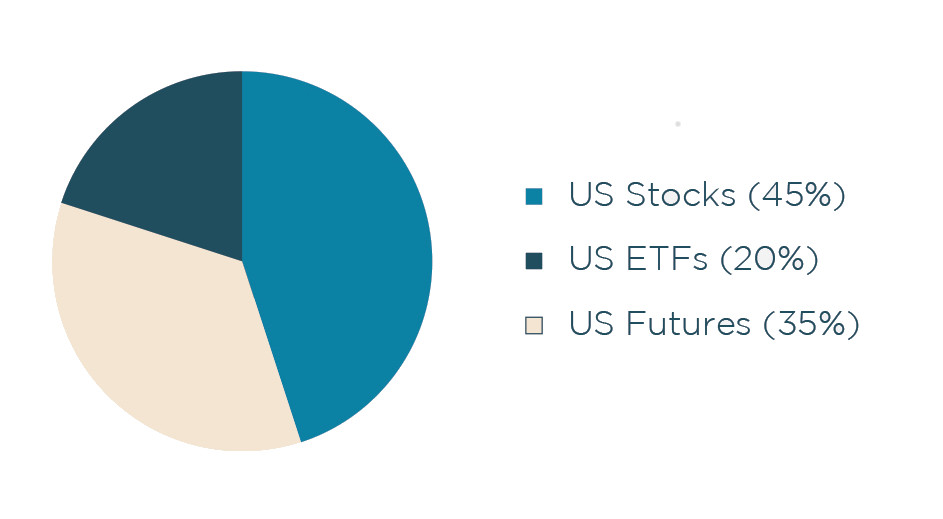

Instruments Traded

Strategies Used

Equity Long/Short

We invest in top companies with high chances of growth. We balance our portfolio with the index so that we are buffered from financial crises.

Equity/Bond/Commodity Balanced

Our algorithms aim to find the right balance between these assets and adapt automatically to different market conditions.

Futures Trend Following & Mean Reversion

These strategies offer a greater diversification across various micro and macro scenarios. The products they trade include: commodities, indices, interest rates, bonds and currencies.

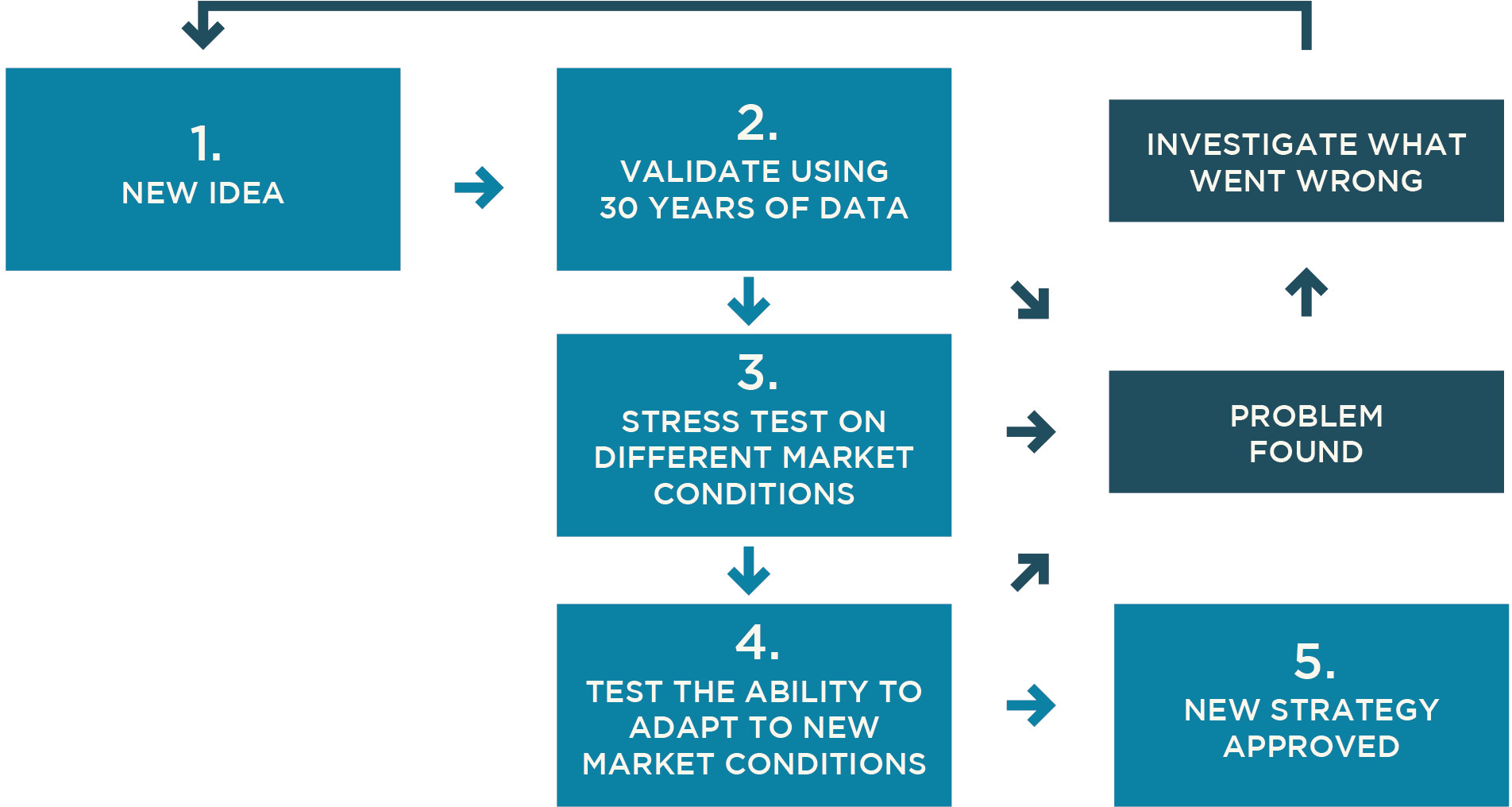

Research Process

Frequently Asked Questions

Is it risky?

The standard measure of risk in finance is volatility. Our volatility is less than the expected return.

Is algorithmic trading popular abroad?

Yes, seven out of the ten biggest funds in the world are currently using algorithmic strategies. Some of the most successful investors have their own systematic funds which they keep closed to outside clients in order to maximize profit.

What safeguards do you have in place?

We have several layers of safety in our system:

- Automated detection: the system stops and requests supervision when there is a risky or abnormal situation.

- Preemptive limits: the system cannot take big positions on a single security or send too many consecutive orders.

- Manual control: we constantly monitor the trading activity and we can manually intervene at any time.

- Meticulous testing: the system has been used and tested for three years.

Do you use high-frequency trading techniques?

No, we only execute a few trades per day.

Is your system a black box?

No, our strategy research process starts from ideas used by human traders in top investment banks. Every trade can be justified using the same reasoning a trader would use. The difference is that algorithms are often able to see opportunities that are hidden using conventional tools.

Do you trade Lebanese instruments?

No, we trade only US securities via a US broker and our servers are placed in Europe and US. In the event of any instability, your investment remains safe.

This portfolio seems consistently profitable year after year. Can you guarantee that if I invest with you I will never lose money?

Although it is not possible to guarantee returns because market conditions change constantly, our consistent performance and our continuous research of new strategies give us the confidence to aim for excellent performance in the foreseeable future.

Do you invest your own money in this product?

Yes we do. This guarantees that our interest is aligned with the interest of our clients.

CONTACTS

Get in Touch

info@algotraders.ai

London

168 Wardour St, Soho

AlgoTraders