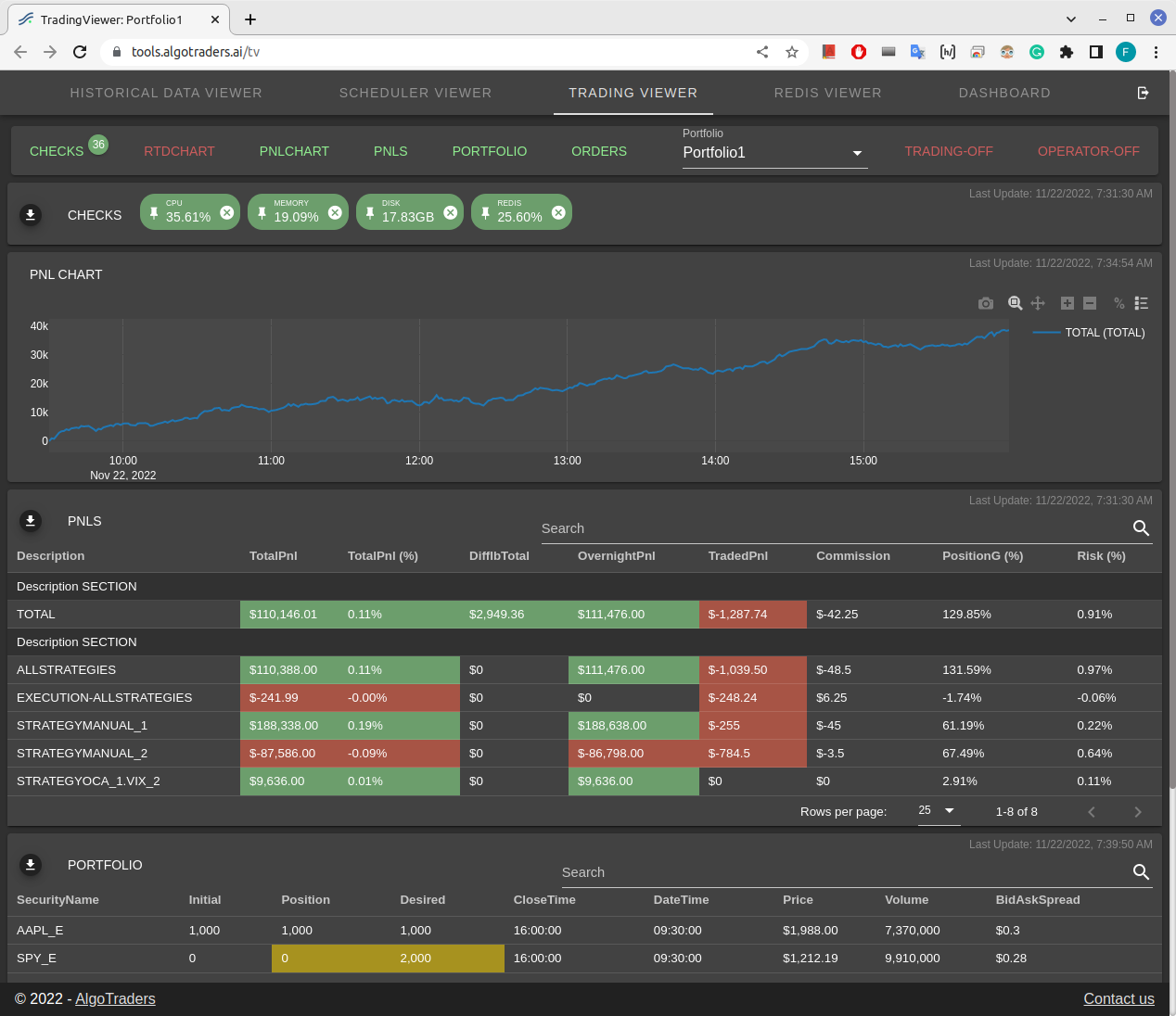

Benefits:

-

One-stop solution for handling of all quantitative trading

needs.

-

Customizable and integrable modules, saving thousands of

hours in development and research.

-

Reduced infrastructure/costs for new clients (automated

back, middle, and front-office).

-

Ability to review trading activity from anywhere (phone,

tablet, desktop, etc).

-

Advanced reporting on slippage, trades analysis, and

strategies live performance.

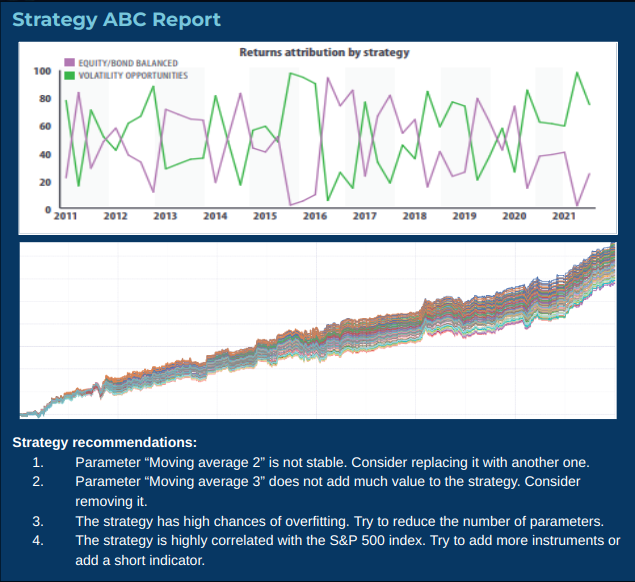

Benefits:

-

Recommendation system for helping quants improve their

strategies’ performance.

-

Proprietary technology: algorithms not available in

scientific literature. Research developed by a team of

experts in Statistics, Finance, & Machine Learning.

-

No advanced Mathematics degree or PhD required to use

these tools.

-

Gives an edge over traditional techniques (e.g. choosing

the strategy with even the best parameters statistically

brings sub-par returns).

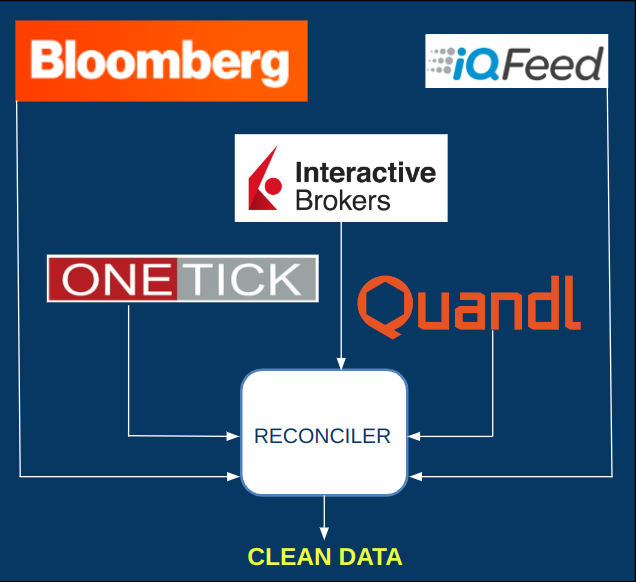

Benefits:

-

Automated download, clean-up, and reconciliation of

historical data across multiple sources.

-

Automated errors detection and correction algorithms.

-

Tools for reviewing and correcting errors manually.

- Data distributed as analytics via cloud.

-

Supports stocks, etfs, futures, options, and currencies.

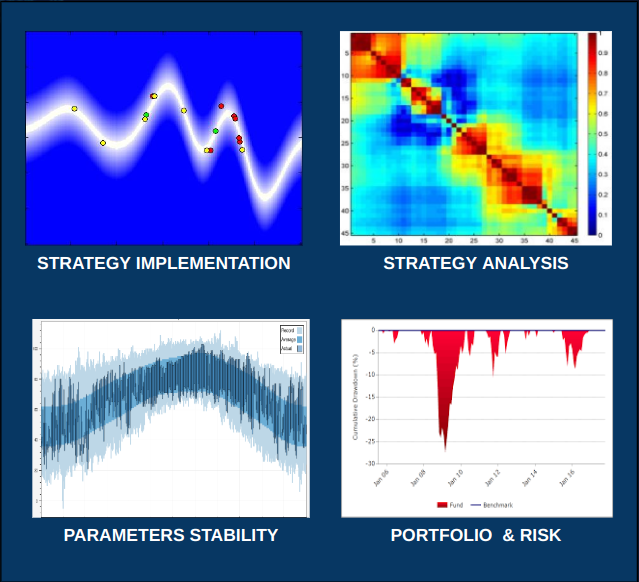

Benefits:

-

Library for backtesting quantitative strategies in

parallel on the cloud or in calc-farms.

-

The strategies simulator handles daily, minute, and second

data. Interface in python and implementation in c++.

- Portfolio and risk-analysis tools.

-

Proprietary reports to analyze trading strategies:

- Sensitivity analysis

- Costs analysis

- Parameters & overfitting analysis

-

Analysis by long/short, instrument type, sector, etc.