Quantitative Strategies for Financial Institutions

Each strategy:

- Has undergone at least 6 months of live testing in a quantitative fund.

- Is the result of 1,000+ hours of PhD+ level research.

- Is offered with exclusive IP and usage rights.

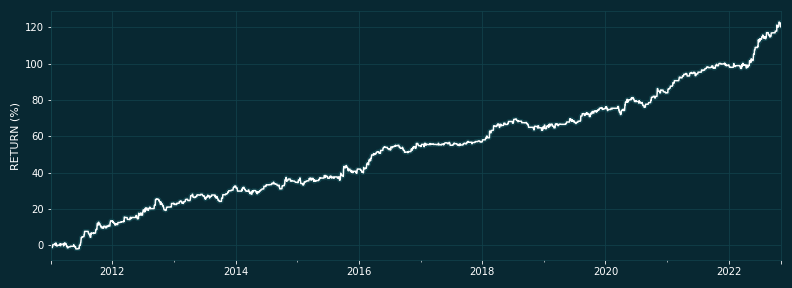

Strategy AT01

- Yearly Return: 9.80%

- Yearly Volatility: 7.13%

- Max Drawdown: 6.36%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday

- Price: $10M

Event Driven: Long Stock Bias

This strategy benefits from stocks' long bias and trades during quiet times.

Positions are not held overnight.

It has low correlation with equity markets and the other strategies offered.

Download Monthly Returns

Contact us

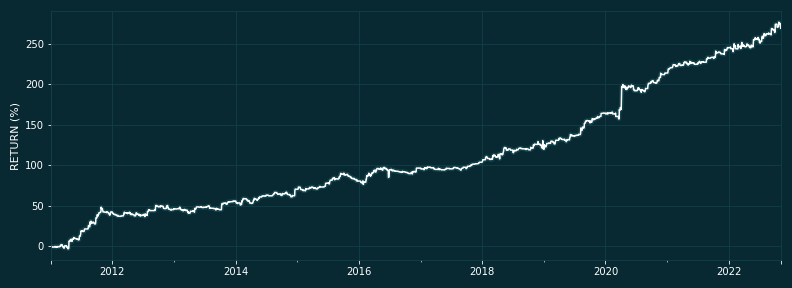

Strategy AT02

- Yearly Return: 22.01%

- Yearly Volatility: 16.17%

- Max Drawdown: 13.82%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday and Overnight

(SOLD) Event Driven: Company Announcements

This strategy triggers on company announcements and requires subscription to a news feed.

It has low correlation with equity markets and the other strategies offered.

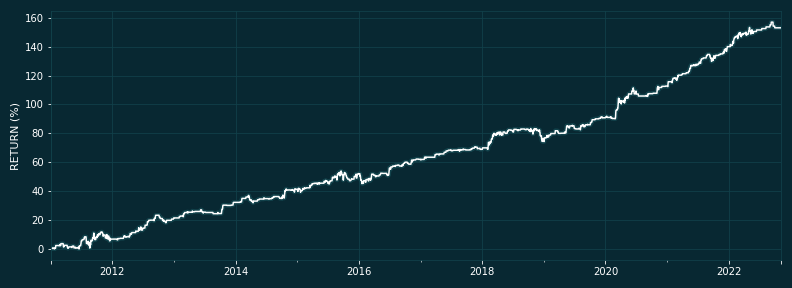

Strategy AT03

- Yearly Return: 16.81%

- Yearly Volatility: 12.22%

- Max Drawdown: 11.26%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday and Overnight

- Price: $10M

Event Driven: Rebounds

This strategy benefits from market rebounds. It occasionally trades overnight.

It has low correlation with equity markets and the other strategies offered.

Download Monthly Returns

Contact us

Strategy AT04

- Yearly Return: 12.52%

- Yearly Volatility: 8.39%

- Max Drawdown: 9.01%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday

- Price: $12M

Event Driven: Intraday Trend Following

This is a long-only trend-following strategy on equities.

It closes its positions by the end of the day.

It has low correlation with equity markets and the other strategies offered.

Download Monthly Returns

Contact us

Strategy AT05

- Yearly Return: 10.33%

- Yearly Volatility: 9.04%

- Max Drawdown: 15.28%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday and Overnight

- Price: $8M

Event Driven: Overnight and Intraday Opportunities

This strategy triggers on predeterminated events, either overnight or intraday.

It liquidates its positions within 24 hours.

It has low correlation with equity markets and the other strategies offered.

Download Monthly Returns

Contact us

Strategy AT06

- Yearly Return: 8.73%

- Yearly Volatility: 8.77%

- Max Drawdown: 9.41%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday

(SOLD) Event Driven: Mean Reversion on Market Turmoil

This strategy takes advantage of mean-version of the prices after market turmoils.

It has low correlation with equity markets and the other strategies offered.

Strategy AT07

- Yearly Return: 11.95%

- Yearly Volatility: 7.20%

- Max Drawdown: 8.03%

- Capacity: > $1B+

- Long-only

- Leverage: 2X

- US Equities

- Intraday

- Price: $14M

Event Driven: Low-Volatility Regimes

Trend following strategy that takes advantage of low-volatility environments.

It has low correlation with equity markets and the other strategies offered.

Download Monthly Returns

Contact us